The Mortgage Broker Assistant Statements

Wiki Article

The Main Principles Of Mortgage Broker Job Description

Table of ContentsThe 7-Minute Rule for Broker Mortgage FeesMortgage Broker Fundamentals ExplainedMortgage Broker Association - An OverviewMortgage Broker Vs Loan Officer Things To Know Before You Get ThisThe smart Trick of Mortgage Brokerage That Nobody is Talking AboutHow Broker Mortgage Meaning can Save You Time, Stress, and Money.The Ultimate Guide To Broker Mortgage FeesThe 6-Minute Rule for Mortgage Brokerage

A broker can compare car loans from a bank as well as a lending institution, as an example. A lender can not. Banker Income A mortgage banker is paid by the organization, generally on a wage, although some establishments provide financial rewards or perks for efficiency. According to , her initial responsibility is to the organization, to see to it fundings are properly protected and also the customer is entirely certified as well as will make the finance settlements.Broker Payment A home mortgage broker stands for the debtor greater than the loan provider. His obligation is to get the borrower the most effective deal possible, despite the institution. He is generally paid by the car loan, a kind of commission, the distinction in between the rate he gets from the lending institution and also the price he offers to the borrower.

10 Easy Facts About Mortgage Broker Job Description Shown

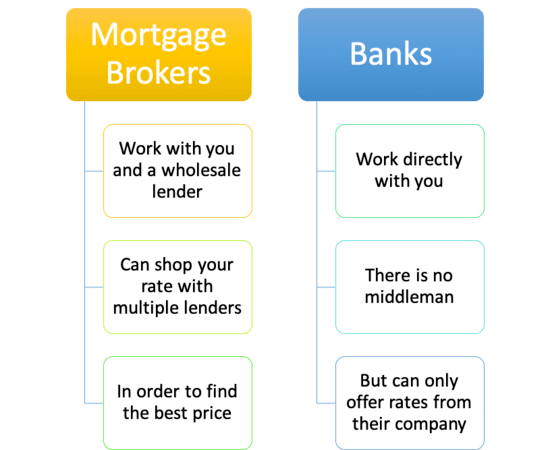

Jobs Defined Recognizing the benefits and drawbacks of each could aid you choose which occupation course you want to take. According to, the primary distinction in between both is that the bank home mortgage policeman stands for the items that the financial institution they benefit deals, while a mortgage broker functions with numerous loan providers as well as works as an intermediary in between the lenders as well as client.On the other hand, financial institution brokers might find the job mundane after a while considering that the procedure typically stays the exact same.

All About Broker Mortgage Near Me

What Is a Loan Police officer? You might recognize that discovering a finance policeman is a vital action in the procedure of acquiring your finance. Let's discuss what loan officers do, what expertise they need to do their work well, as well as whether finance policemans are the most effective option for debtors in the funding application screening procedure.

A Biased View of Broker Mortgage Rates

What a Lending Police officer Does, A lending police officer works for a financial institution or independent lender to assist consumers in looking for a finance. Since many consumers work with finance police officers for home useful source mortgages, they are frequently referred to as mortgage car loan policemans, however several lending officers help borrowers with various other lendings.If a lending police officer believes you're eligible, after that they'll recommend you for authorization, and also you'll be able to proceed on in the procedure of acquiring your car loan. What Lending Police Officers Know, Funding officers need to be able to work with customers and little organization owners, as well as they must have substantial knowledge regarding the sector.

An Unbiased View of Mortgage Broker Average Salary

4. Just How Much a Loan Officer Costs, Some car loan policemans are paid through compensations. Home loan have a tendency to lead to the largest payments due to the dimension and work linked with the financing, yet payments are commonly a negotiable prepaid charge. With all a financing policeman can do for you, they have a tendency to be well worth the expense.Car loan officers understand all about the lots of sorts of finances a lending institution may use, and they can provide you suggestions about the very best alternative for you as well as your circumstance. Discuss your demands with your funding police officer. They can help guide you towards the ideal loan type for your circumstance, whether that's a traditional lending or a jumbo lending.

All About Broker Mortgage Rates

2. The Duty of a Loan Police Officer in the Screening Refine, Your finance policeman is your direct get in touch with when you're requesting a finance. They will investigate and also examine your financial history and also evaluate whether you receive a home loan. You will not need to worry regarding frequently contacting all the individuals entailed in the home loan process, such as the expert, internet property representative, settlement attorney as well as others, because your finance officer will certainly be the factor of contact for all of the included events.Due to the fact that the procedure of a loan transaction can be a facility and also pricey one, several customers choose to work with a human being instead than a computer system. This is why banks may have numerous branches they desire to offer Mortgage broker the potential consumers in different areas who desire to fulfill face-to-face with a loan police officer.

Broker Mortgage Calculator for Dummies

The Role of a Car Loan Officer in the Funding Application Refine, The home loan application procedure can feel overwhelming, especially for the first-time homebuyer. When you work with the right funding policeman, the process is actually pretty simple.Throughout the finance handling stage, your loan police officer will certainly contact you with any inquiries the financing cpus may have concerning your application. Your financing policeman will after that pass the application on to the underwriter, that will assess your creditworthiness. If the expert authorizes your finance, your finance policeman will after that gather and prepare the ideal loan shutting papers.

The 20-Second Trick For Broker Mortgage Fees

Exactly how do you select the appropriate lending policeman for you? To start your search, begin with loan providers that have an excellent credibility for exceeding their clients' assumptions and maintaining sector criteria. As soon as you have actually picked a loan provider, you can then begin to limit your search by interviewing funding officers you may want to function with (broker mortgage calculator).

Report this wiki page